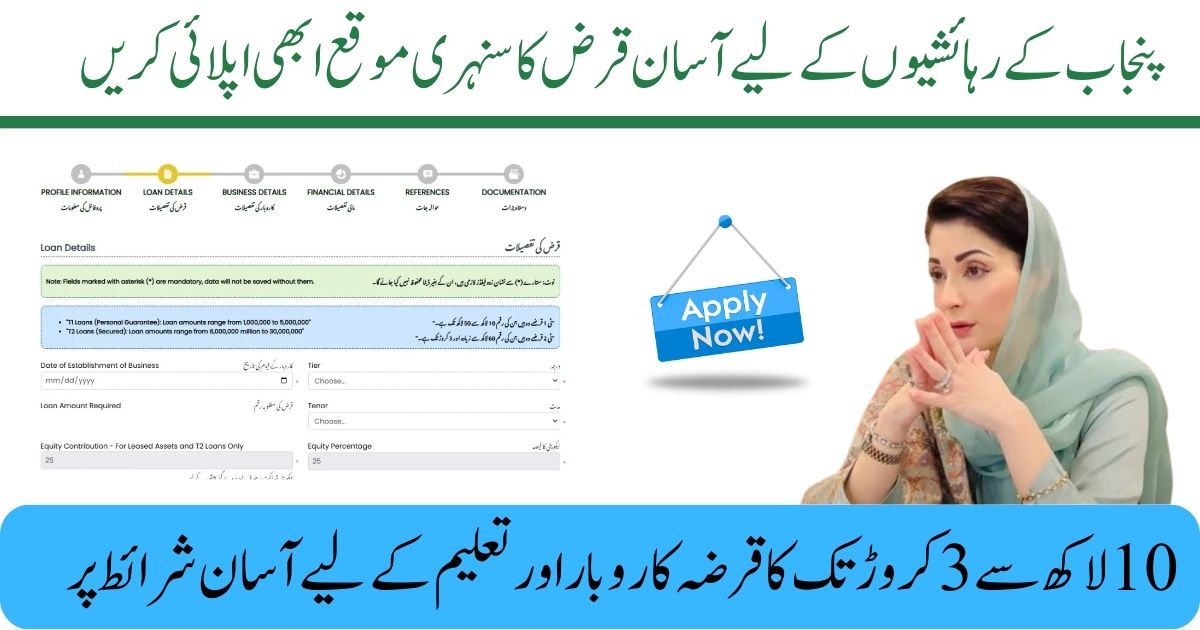

The Punjab Government has rolled out a powerful new loan program to help residents chase their dreams without drowning in bank paperwork or high interest rates. Whether you want to start a business, grow crops, learn new skills, or continue your studies, this scheme is designed to make it easier and faster to get the funds you need.

This is more than just a loan. It’s a chance to break free from financial roadblocks that have kept many people from moving forward.

Why This Scheme Matters

For years, people in Punjab have struggled to get affordable credit. High markups, strict bank rules, and slow approvals left many with no choice but to give up their plans or turn to expensive moneylenders.

This scheme flips the script:

- Low or zero interest for most borrowers.

- Quick approvals — no more endless waiting.

- Flexible repayments that won’t crush your budget.

Who Can Apply?

The scheme is open to a wide range of people, but here are the main requirements:

- Permanent resident of Punjab.

- Age: 18 to 55 years.

- Valid CNIC from NADRA.

- No past loan default.

- A clear and legal reason for borrowing.

- Website

Priority Groups (Extra Chances of Approval)

The government wants to uplift groups that often face the toughest challenges:

- Women entrepreneurs

- Widows and orphans

- Persons with disabilities

- Small farmers

- Students (college, university, or vocational training)

Loan Options Available

You can apply for different types of loans depending on your needs:

- Business Loans – Start or expand your small business.

- Education Loans – Pay tuition, buy books, or get a laptop.

- Agriculture Loans – Purchase seeds, fertilizers, or equipment.

- Skill Development Loans – Pay for technical training or professional courses.

How Much Can You Borrow?

- Minimum: PKR 50,000

- Maximum: PKR 500,000 (some new programs under Asaan Karobar allow up to PKR 3 crore for SMEs)

- Repayment: 1 to 5 years, depending on your loan type.

- Collateral: Not needed for loans up to PKR 200,000.

How to Apply (Simple Steps)

- Visit the Official Portal – The Punjab Government will soon launch an online application site.

- Fill Out the Form – Share your personal, financial, and loan purpose details.

- Upload Documents – CNIC, proof of residence, income proof, and purpose-related papers.

- Submit Application – Apply online or at a nearby loan center.

- Verification – NADRA and government records will confirm your details.

- Approval & Payment – If approved, money is sent directly to your bank account.

Repayment Made Easy

- Pay through banks, mobile apps, or loan centers.

- No penalty if you pay early.

- Flexible plans — adjust them if your situation changes.

Why This Could Change Lives

- More entrepreneurs → more local jobs.

- Better agriculture → higher crop yields and income.

- More education → stronger workforce.

- Empowered women → stronger communities.

The Bigger Picture

Chief Minister Maryam Nawaz has hinted at expanding the program by:

- Raising loan limits.

- Offering micro-loans via mobile apps.

- Giving free business training and mentorship.

- Reaching deeper into rural Punjab.

Final Word

If you’ve been holding back on a business idea, farming project, or study plan because of money this might be your moment. The Punjab Easy Loan Scheme is not just about cash. It’s about giving you the tools and time to succeed, without the crushing weight of debt.